Congratulations, the mortgage is paid off… and you’re only 111

Lending rules changed to accommodate older borrowers, now mortgage terms are doing the same.

Can you imagine reaching your 100th birthday and receiving your congratulatory message from the Queen — and then having to check whether you have enough money in your current account to cover that month’s mortgage bill?

Traditionally, a mortgage is a thing of the past by the time you retire, but soaring house prices, low or non-existent pay rises and ballooning student debt mean the dream of homeownership is more elusive than ever for the young.

Last week, the communities secretary Sajid Javid told MPs: “Our housing market is broken.” However, it is not just young people who are paying the price.

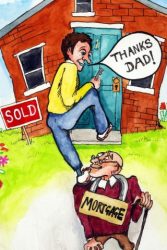

The Bank of Mum and Dad is playing its part too: without it — as Hunter Davies points out in his piece this week — the UK property market would not work.

Money reveals today that one homeowner was even given a mortgage that will run until his 111th birthday — and he only took out the loan to help his son get onto the property ladder.

A mortgage into your hundreds?

Thomas Dakin, 82, had paid off his mortgage shortly after retiring from his job in an oil company 20 years ago.

He and his wife, Gene, 79, enjoyed being mortgage-free for years before they ran into what is a very modern problem. Their son James, who is in his thirties and works in London, was struggling to buy a home.

The couple decided to step in and help him raise a deposit by taking out a £50,000 mortgage on their house near Dumfries, in southern Scotland.

Few lenders would give Dakin a loan because of his age, however, even though he has a final salary pension.

He initially considered taking out an equity release product, which is typically repaid only when the borrower dies, but the interest balloons while they are alive.

Instead, the Dakins found a solution through Cumberland building society, which has one of the most flexible approaches to lending in retirement: an interest-only mortgage with an interest rate of 2.5%. This means each month Dakin must repay only the interest on the loan and not a penny of the capital until the term of the mortgage expires when he turns 111. The deal, which has a term of more than 30 years, was taken out at the end of 2015.

There are more than 14,500 centenarians in the UK, according to the Office for National Statistics. Of these, 850 are aged 105 or older. Dakin, who keeps fit by playing golf three times a week, is not fazed by having a mortgage contract that will end only when he reaches such a ripe old age.

He said: “It was nice to be mortgage-free but I am glad we were able to help my son get on the property ladder. We can easily afford the loan.”

If Dakin or his wife dies before then, the surviving spouse will be able to continue making the payments — or could repay the loan by selling the family home and downsizing. Cumberland said that if both die, “the property and the debt would form part of the estate that the executors would be required to sort out”.

What the experts say

Jonathan Harris of the mortgage broker Anderson Harris said: “We are increasingly seeing grandparents remortgaging their homes to release capital to gift to their grandchildren.”

Real estate lawyers may be needed if you do not have the knowledge yourself and they can assist you in securing a mortgage.

This trend follows improvements in the way lenders approach older borrowers, a response to criticism that they were adopting a discriminatory approach by turning down people purely on the grounds of their age. This followed our Play Fair on Age campaign, which highlighted ageism in the industry.

Paul Green of the over-50s specialist Saga said: “It is great that some lenders are starting to treat customers as individuals but too many still unfairly block older people from the best deals for mortgages and personal loans — for no other reason than that they have, in their view, celebrated too many birthdays.”

Borrowing in retirement

Dakin is one of a growing number of older borrowers taking advantage of more relaxed lending policies. Many lenders had become reluctant to agree to a mortgage term that would end after someone’s 65th birthday — in one case, HSBC was reprimanded by the Financial Ombudsman for telling a couple in their forties that they were too old for a mortgage.

Yet these rules are gradually being eased. In 2015, the Building Societies Association (BSA) published a report on lending into retirement that called for change in the industry. Responding to the report, all 44 mutual lenders pledged to review their age limits — and many have since raised or scrapped them. Today, 33 building societies will lend to somebody until they are in their eighties.

For example, the Family building society has a “retirement lifestyle booster” mortgage aimed exclusively at borrowers aged 60 and over.

Paul Broadhead, head of mortgage policy at the BSA, said: “Building societies are committed to dealing with the realities of our ageing population. However, they will not be able to service all this demand on their own. We need other lenders to take responsibility by reviewing their policies and doing their part.”

The high street banks have been lagging behind, although they too are slowly improving their approach. Last week, Santander raised its maximum age for interest-only borrowers from 65 to 70. Barclays will lend until a customer is 70 or retires, whichever comes sooner.

Ian Gray of the mortgage broker Kinnison said: “Many on the high street need to rethink their blanket age caps. These larger lenders almost always offer the best rates. Therefore, older borrowers are still being penalised every day, because they have a much smaller pool of lenders to choose from.”

Should you help out?

Some experts urge caution before withdrawing money from your home or savings to help younger relatives.

Caroline Abrahams of the charity Age UK said: “Spiralling house prices mean many parents understandably want to help their children get a foot on the property ladder.

“For some, that will inevitably mean dipping into hard-earned retirement savings, which unfortunately may cause problems in future when they are faced with care or other unanticipated costs.”

Don’t let your debt roll up unchecked

Ageism is the only form of discrimination that is encouraged by the authorities — as any would-be borrowers who were born more than 50 or 60 years ago soon discover, writes Ian Cowie.

Since the credit crisis, many lenders automatically refuse applicants who cannot show that they will repay before reaching 70 years of age.

Equity-release plans secured against property are a popular but expensive solution to this problem. Older homeowners used these roll-up loans — where typically no interest is paid until the debt is cleared after the borrower’s death — to raise a record £2.2bn last year.

Unfortunately, compound interest is a cruel taskmaster and allowing debts to roll up unchecked can have catastrophic effects. For example, as Richard Eagling at the independent statisticians Moneyfacts points out: “A £50,000 roll-up lifetime mortgage with an interest rate of 7% will have almost doubled to £98,358 in 10 years, or hit £137,952 in 15 years.”

With more of us living longer, those numbers could add up to an unpleasant surprise for some borrowers, but one bank — which can trace its origins back nearly 250 years — is offering a cheaper way for septuagenarians to raise cash.

Founded in 1770, Weatherbys was set up to serve the horse-racing fraternity but did not obtain a banking licence until 1994. It is authorised by the regulator, the Financial Conduct Authority, so depositors are protected by the Financial Services Compensation Scheme, and it lends to homeowners aged 70 and over at Bank of England base rate plus 3.25 percentage points, so the current charge is 3.5%.

The rub is an arrangement fee of 1% of the amount you borrow and a requirement that your net worth in property or shares must be at least £1m.

Quentin Marshall, Weatherbys’ deputy head of private banking, said: “We see the person, not their age.”

Loans often help to buy a grandchild’s first home, so you could say Weatherbys is betting on the intergenerational sweepstakes. It’s a funny old world if an institution founded nearly a quarter of a millennium ago can be described as a “challenger bank”, but this one is coming up fast on the rails.